A lot has changed in the world since calculators first became popular. We used to have to carry around large, cumbersome devices that could only do basic arithmetic. Now, we can fit an entire calculator in our pocket, and we can use it to perform complex mathematical operations in the blink of an eye. One of the most common calculations that people need to make is figuring out their percentage gain or loss on an investment. In this article, we will teach you how to do just that!

Determining Percentage Gain or Loss

There are a few different ways to calculate your percentage gain or loss. The most common method is to take the difference between the original value of the investment and the current value of the investment, and then divide that number by the original value. This will give you your percentage change. For example, let’s say you originally invested $100 in stock, and it is now worth $110. To calculate your percentage gain, you would take the difference ($110 – $100), which is $11, and divide it by the original value ($100). This gives you 11%, which is your percentage gain. If your investment had lost money and was now only worth $90, you would follow the same steps but would end up with a percentage loss of -$11/$100, or 11%.

Another way to calculate percentage gain or loss is by using the following formula: (current value – original value)/original value. This formula will give you the same result as the one above.

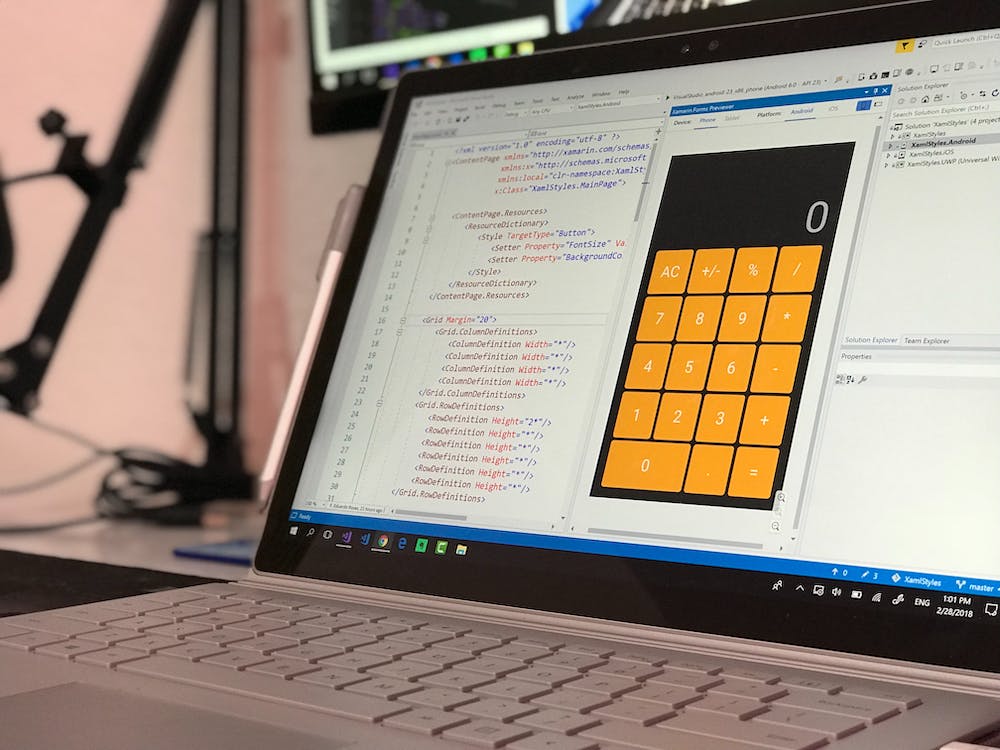

You can also use this calculator to figure out your percentage gain or loss. Simply enter in the original value of your investment, the current value, and hit “calculate.” The calculator will do the rest!

Why Is It Important to Know Your Percentage Gain or Loss?

There are a few different reasons why it might be important for you to know your percentage gain or loss. For one, it can help you track how well your investment is doing over time. If you notice that your investment is consistently losing money, it might be time to reconsider your strategy. Additionally, if you are trying to reach a financial goal, knowing your percentage gain or loss can help you determine how close you are to reaching that goal. For example, let’s say you’re trying to save up for a down payment on a house. You might set a goal of saving $20,000 in two years. If you know that your savings account is earning interest at a rate of 12% per year, then you can use that information to calculate how much money you will have at the end of the two years.

Knowing your percentage gain or loss can also be helpful when it comes time to pay taxes. If you have made a profit on your investment, you will need to pay capital gains tax on that money. The amount of tax you owe will depend on how much money you made and what tax bracket you are in. On the other hand, if you have lost money on your investment, you may be able to deduct that loss from your taxes.

Now that we’ve gone over how to calculate your percentage gain or loss, as well as why it’s important to know this information, let’s take a look at some tips for maximizing your profits and minimizing your losses.

Tips for Maximizing Your Profits

There are a few different things that you can do to try to maximize your profits when investing. One thing that you can do is invest in a diversified portfolio. This means that you should not put all of your eggs in one basket. Instead, you should spread your money out across a variety of different investments, such as stocks, bonds, and mutual funds. This will help to protect you if one particular investment loses value.

Another thing that you can do to try to maximize your profits is to reinvest your dividends. When a company pays out dividends, you have the option of reinvesting that money back into the company. This is a good way to grow your investment over time without having to put any additional money into it.

And finally, another thing that you can do to try and maximize your profits is to keep an eye on the market and buy low and sell high. This means that you should try to buy when the market is down and prices are low, and then sell when the market is up and prices are high. Of course, this is easier said than done, but it’s a good general strategy to follow.